Renters Insurance in and around Nashville

Renters of Nashville, State Farm can cover you

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Your rented townhome is home. Since that is where you rest and make memories, it can be a wise idea to make sure you have renters insurance, whether or not your landlord requires it. Even for stuff like your bed, towels, boots, etc., choosing the right coverage can make sure your stuff has protection.

Renters of Nashville, State Farm can cover you

Renters insurance can help protect your belongings

State Farm Has Options For Your Renters Insurance Needs

Renters often don’t realize that their landlord’s insurance only covers the structure. Just because you are renting a apartment or townhome, you still own plenty of property and personal items—such as a cooking set, bicycle, a piece of family jewelry, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why secure your belongings with renters insurance from Craig McElhaney? You need an agent who is dedicated to helping you understand your coverage options and examine your needs. With dedication and personal attention, Craig McElhaney is waiting to help you keep your things safe.

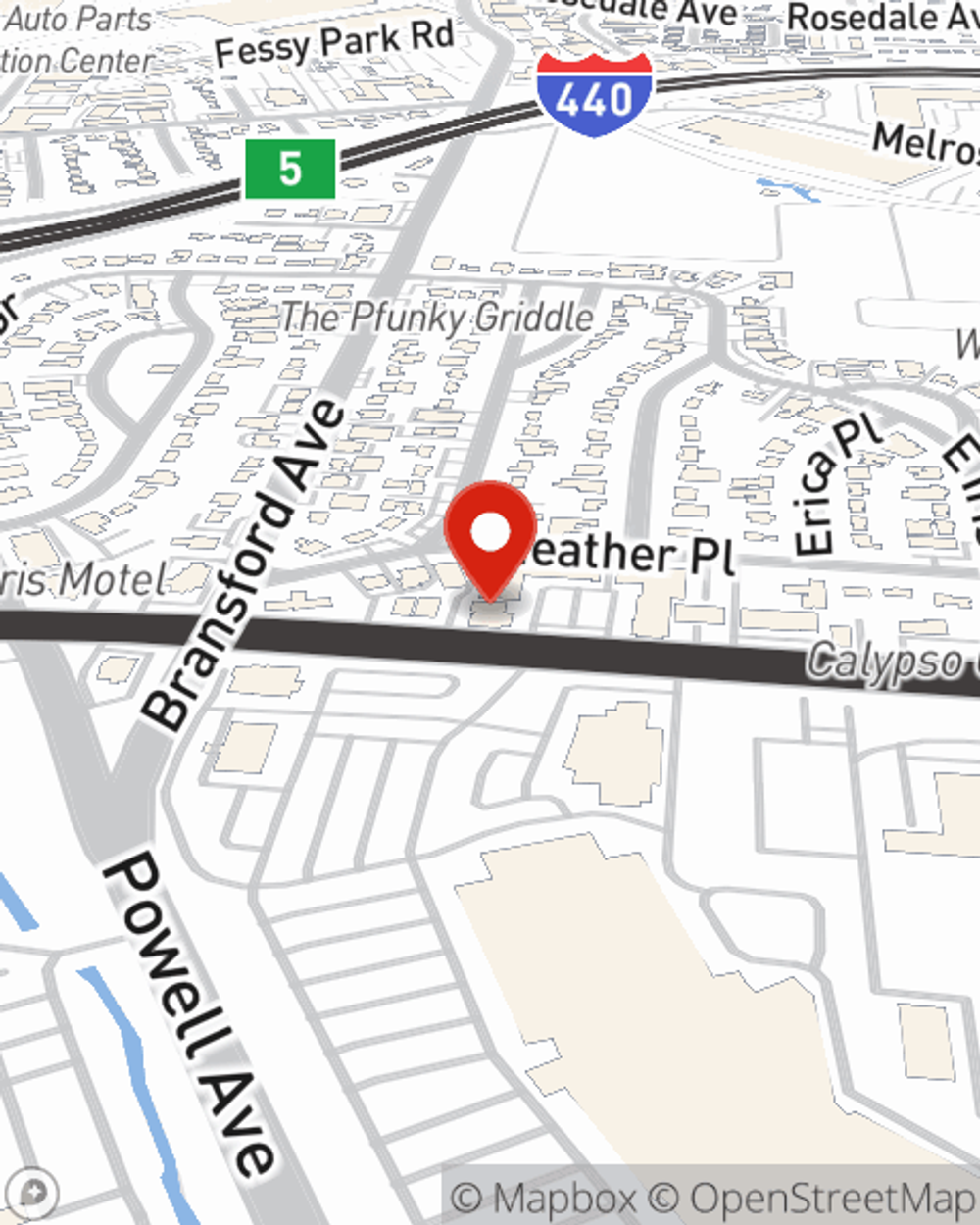

Renters of Nashville, visit Craig McElhaney's office to get started with your personalized options and how you can benefit from State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Craig at (615) 386-9335 or visit our FAQ page.

Simple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.

Craig McElhaney

State Farm® Insurance AgentSimple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.